ERCOT prices flare as strong demand, weak wind test Texas grid

ERCOT is not out of the woods yet

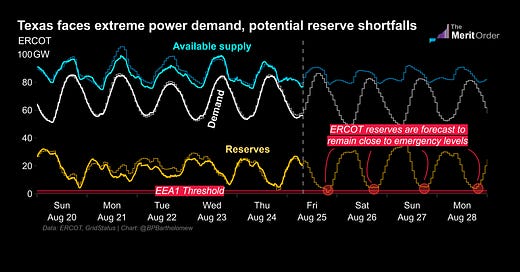

Texas remains primed for tight grid conditions and power price eruptions. For the second day in a row, ERCOT has issued an advisory for projected reserve capacity shortages and called for energy conservation where safe.

Rotating outages remain unlikely without significant deviations from ERCOT’s forecast.

ERCOT narrowly skated through extreme heat and waning reserves yesterday, with calls for electricity conservation and unexpected Houston rain helping the grid weather a trying afternoon and evening.

Online reserves (white line in the chart below) bottomed out around 4,300MW at 8pm. Emergency conditions are triggered when reserves fall below 2,300MW without expectations of quick recovery.

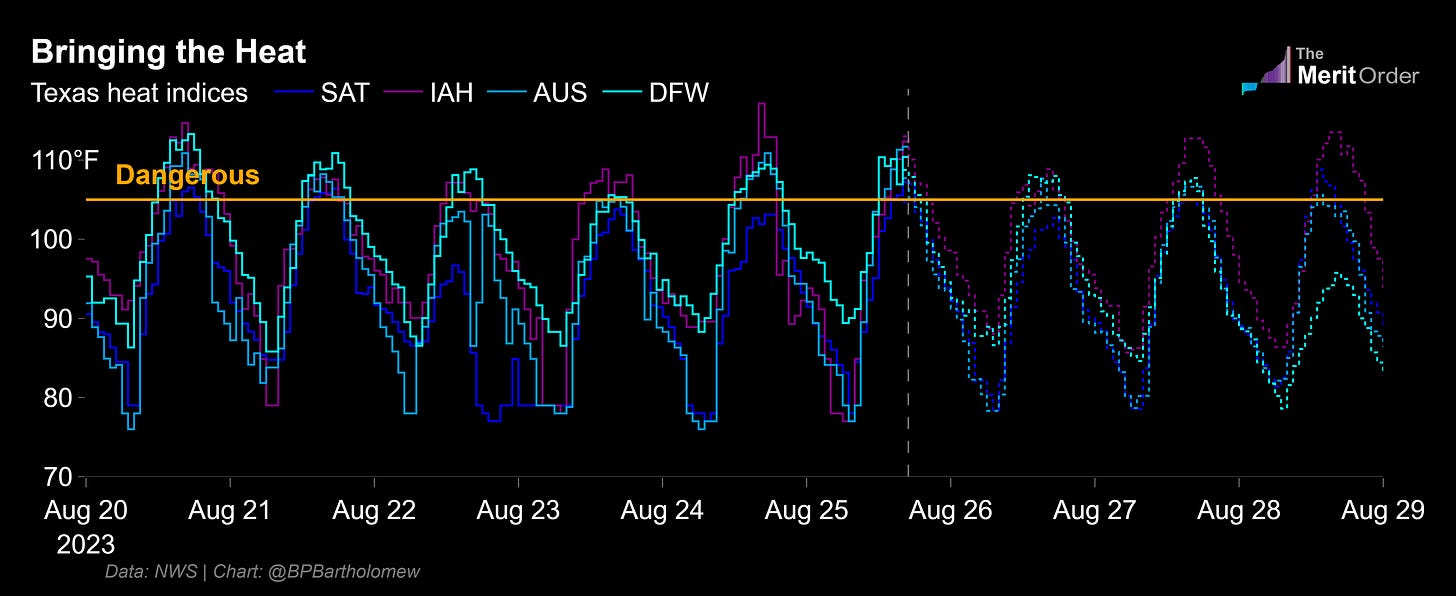

ERCOT faces a potentially greater challenge today. Demand forecasts are higher; wind forecasts are lower. Reserves are forecast to fall further, and day-ahead power prices will reach their highest levels so far this summer.

Day-ahead energy prices will take off through the afternoon, eventually topping $4,000/MWh from HE18-20.

The chart below shows estimated supply, demand, and reserves available to ERCOT.1 Reserves are expected to again fall near emergency levels later today and remain in similar ranges through Monday.

Short and not so sweet

While serious, any potential power outages this summer would also likely be shallow, controlled, and short—aligning with spiky summer demand profiles and tight operating margins—rather than the extended, deep deficits and longer outages seen during Winter Storm Uri.

ERCOT’s expensive price spike habit

Yesterday and today alone, ERCOT’s day-ahead market energy market has cleared more than $3bn in value.2 The value of day-ahead electricity this afternoon and evening alone will reach nearly $2bn, before accounting for gigawatts of ancillaries, of which ERCOT is procuring more than ever.

Altogether, the value of energy in ERCOT’s day-ahead market has reached nearly $12bn so far this August. This will be the most expensive summer month in ERCOT history, and the most expensive month ever for ERCOT outside of February 2021.

More charts:

ERCOT trends to watch:

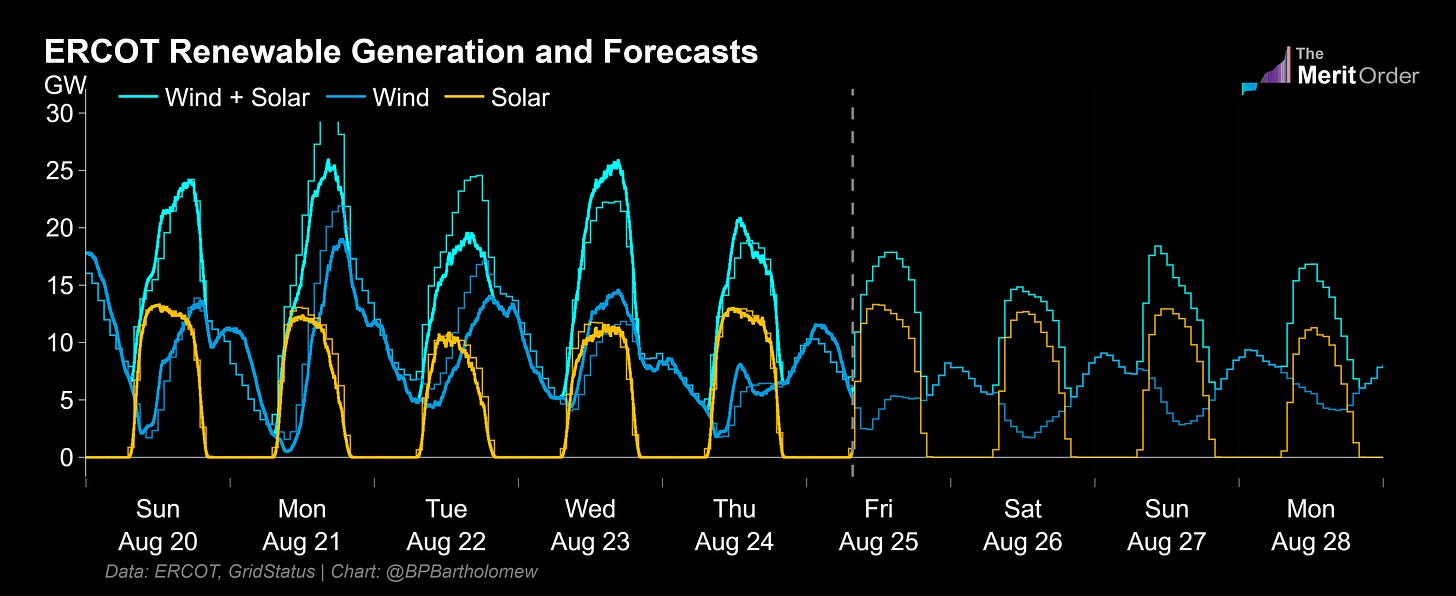

Natural gas and coal still do the heavy lifting on the Texas grid, especially when demand is highest, but the gap between demand and dispatchable capacity and resulting reliance on wind and solar means that Texas is more than ever a renewable-driven market.

Summer prices are highest and grid conditions are now tightest not on days when demand is strongest, but when demand is relatively high and wind generation slumps too far below its seasonal averages. Net demand is a better indicator than gross demand for Texas grid conditions today.

ERCOT’s burgeoning solar fleet helps put a 13GW+ floor under variable afternoon renewable generation, relieving the market of some its traditional reliance on wind’s daily dice roll.

As solar saturates daytime hours, the most potent ERCOT prices and slimmest reserve margins will continue to migrate from high-demand but sundrenched afternoons to the later evening when demand drops marginally but solar generation falls off a cliff.

Deeper solar penetration means fewer power price spikes for all generators in the daytime hours, but disproportionate cannibalization of its own margins.

Batteries are helping boost reliability ‘under the hood’ by providing several gigawatts of ancillary services; their contribution in energy markets will become more apparent over time as ancillary markets saturate.

ERCOT carries more operational reserves than appear on this helpful but ambiguous and often-misinterpreted ERCOT display here.

Simple calculation of day-ahead load forecast * hub average day-ahead energy prices, before accounting for ancillaries or other costs.