Tropical Storm Hilary batters California solar

Far from the most important effect of Tropical Storm Hilary, but the uncharacteristic California summer storm is suppressing CAISO solar well below typical August levels.

Hilary is also muting California electricity demand below recent highs, and ample supply is available—wholesale prices are a snoozefest even without the normal dose of midday summer solar.

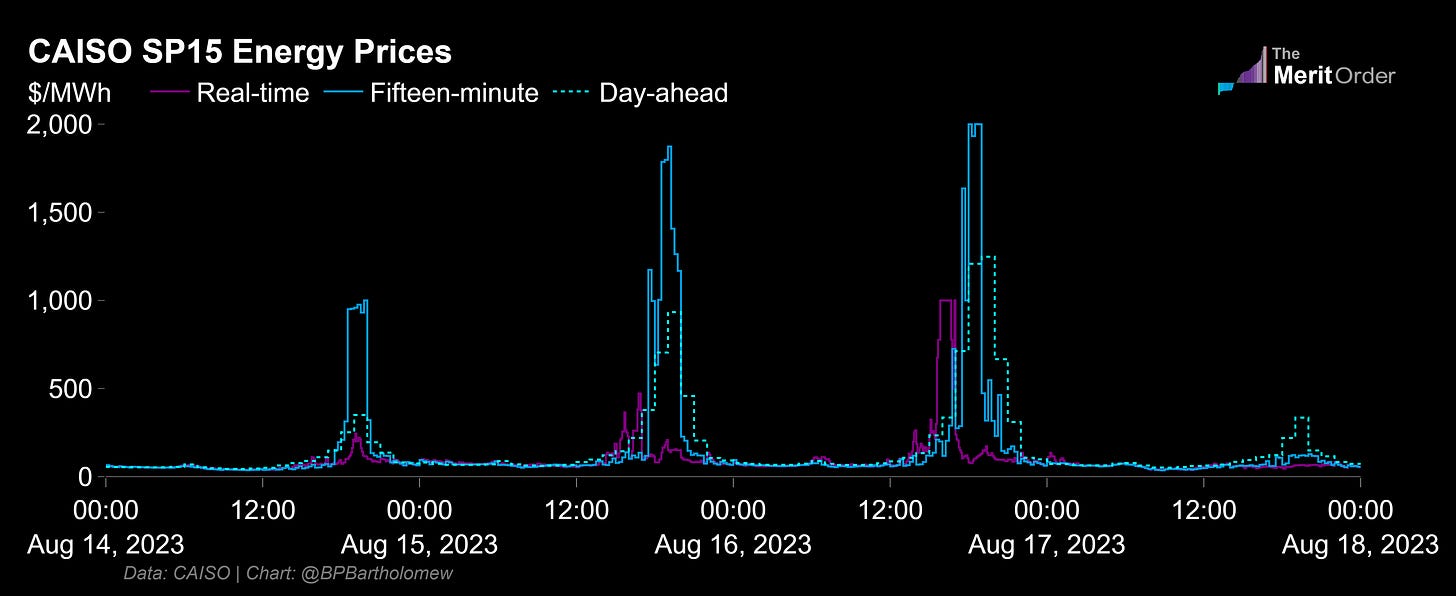

This extreme weather is a much smaller challenge to balancing California power supply and demand than the previous week, when high temperatures pushed CAISO SP15 day-ahead energy prices over $1,000/MWh and well beyond the soft offer cap in the fifteen-minute market.

California’s disappearing imports

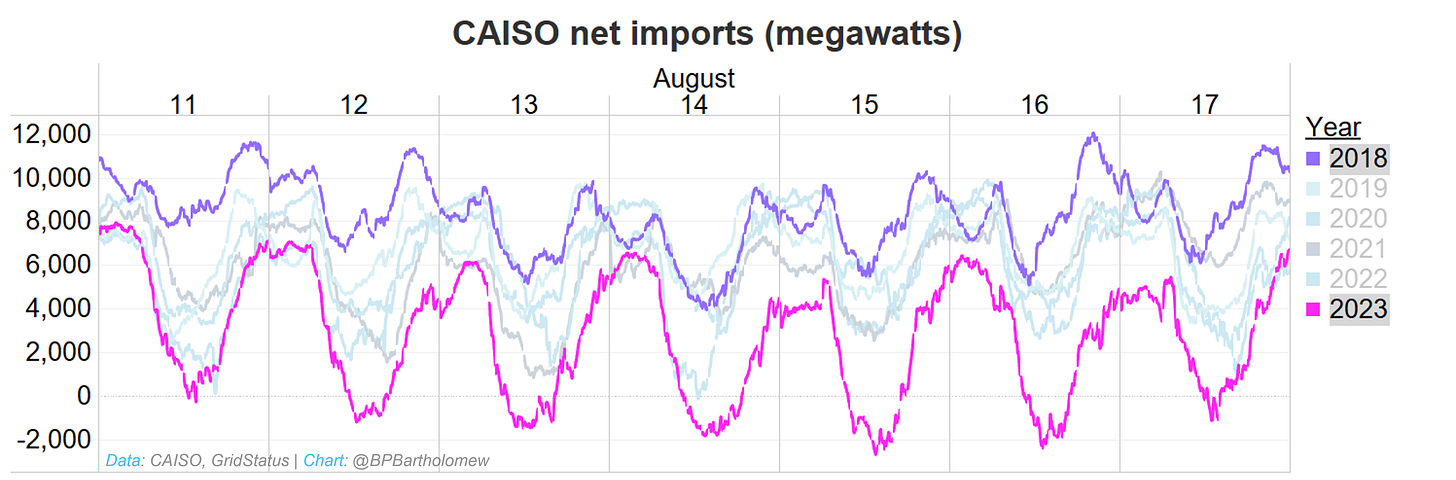

One of the more striking trends through last week’s heat wave and a throughline from recent years is CAISO’s evaporating imports—bullish for California power prices, and challenging for California climate goals and reliability.

The chart below shows the CAISO power mix from last week vs. the same stretch five years ago. Among other changes, solar and batteries are carrying more load than ever, but imports have vastly diminished (even flipping to unprecedented midday summer exports!) producing a greater need for internal gas generation to fill the gap.

Neighbors—they’re just like us!

Neighboring grids are going down the same path as California: retiring thermal fleets, moving to lower carbon but more intermittent power mixes. The PNW is also still suffering through poor water years, and load is growing across the west. All of these things mean fewer imported, dispatchable MW available to California than in the past.

The chart below shows net imports by year broken out over the same stretch as the pane above. Even in summer, and most importantly during hot evening hours, CAISO now gets only a fraction of what it could previously rely on from imported power.

In the immediate term, less external supply also means CAISO hits extreme power prices at much lower levels of demand. As Peg Leg notes on Twitter (X?), California’s diminishing imports are producing tighter supply-demand conditions at lower levels of demand than even just a year ago.

More extreme heat and power prices in ERCOT

Meanwhile in Texas, ERCOT’s historic run of soaring temperatures and power prices continues, with extended extreme prices last Thursday and calls for voluntary conservation on both last Thursday and Sunday.

This week should start with a quiet two days before the combination of strong demand and weak wind again produces power price spikes and tighter grid conditions.

August 2023 is on track to be ERCOT’s hottest summer in at least a decade, potentially surpassing 2011.

It will also potentially be ERCOT’s most expensive summer month ever, with wholesale electricity prices on track to settle at their highest levels in the market’s history outside of February 2021 (Winter Storm Uri).

The ORDC is dead, long live SCED

ERCOT volatility continues to express itself through extreme energy price offers when reserves remain abundant rather than reserve price adders when reserves are truly scarce.

This outcome has implications for both short-term reliability (and affordability!) as well as longer-term reserve margin rejuvenation.

To be continued…

What's the story with the decrease in CAISO imports? Out of state firm generation chased away by low prices when the sun is shining?

'extreme energy price offers when reserves remain abundant rather than reserve price adders when reserves are truly scarce'

No idea, but does this point toward concentrated market power? Cartel like behavior? 'We (and our partners- informally- have a monopoly on the last in pricing - so we're going to set the price wherever we damn well please.'