Texas power market crushes more electricity demand records, soaks up summer heat

Peak Texas electricity demand now exceeds conventional power supply

Texas electricity demand is forecast to hit record 85GW+ peaks through the end of the week.

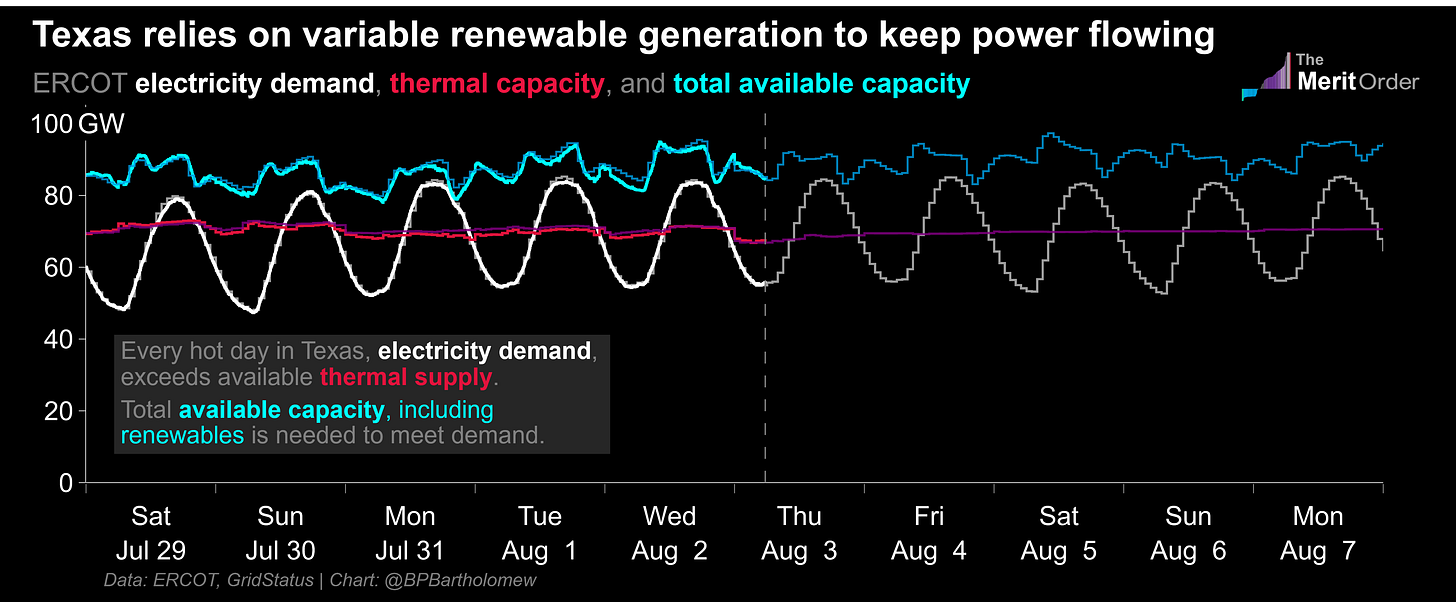

Every hot day in Texas, electricity demand exceeds conventional power supply.

ERCOT relies more than ever on variable wind and solar to hit the highest peaks of summer demand.

Another day, another Texas electricity demand record

Texas temperatures remain on the rise and electricity demand records continue to fall. ERCOT load reached 83.6GW from 4-5pm on Tuesday, setting a new high for the fourteenth time so far this summer.

Stronger electricity demand is possible through the next week, with forecast peaks more than 4GW higher than in 2022 and reaching a full 10GW higher than peak summer demand from as recently as 2019.

Temperatures remain at extreme levels in what is shaping up to be the hottest Texas summer in more than a decade.

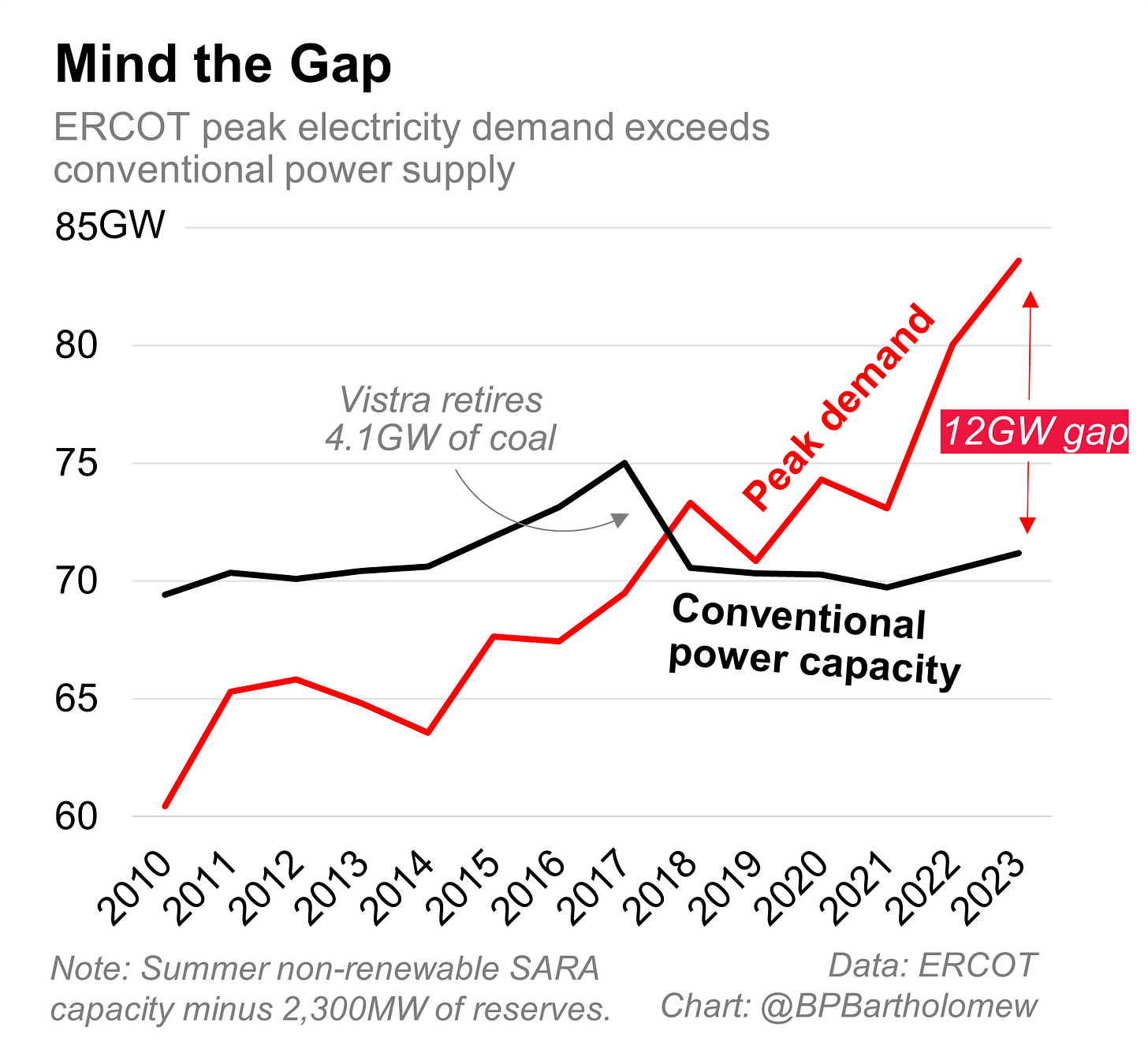

Mind the gap.

While electricity demand and nameplate power capacity are growing in Texas, thermal capacity is not. As a result, there’s now a 12GW gap between conventional power supply and summertime peak demand.

The chart below compares ERCOT’s highest summer electricity demand each year against availability-adjusted conventional power capacity.

The market has been fundamentally short on thermal supply ever since Vistra retired several gigawatts of coal in 2018.

The result: every hot day in Texas, electricity demand exceeds dispatchable power supply. The chart below show’s ERCOT available thermal power capacity, electricity demand, and total available capacity as it plays out day to day.

Conventional power still provides the bulk of supply, but hitting daily demand peaks requires additional wind and solar to keep the lights on.

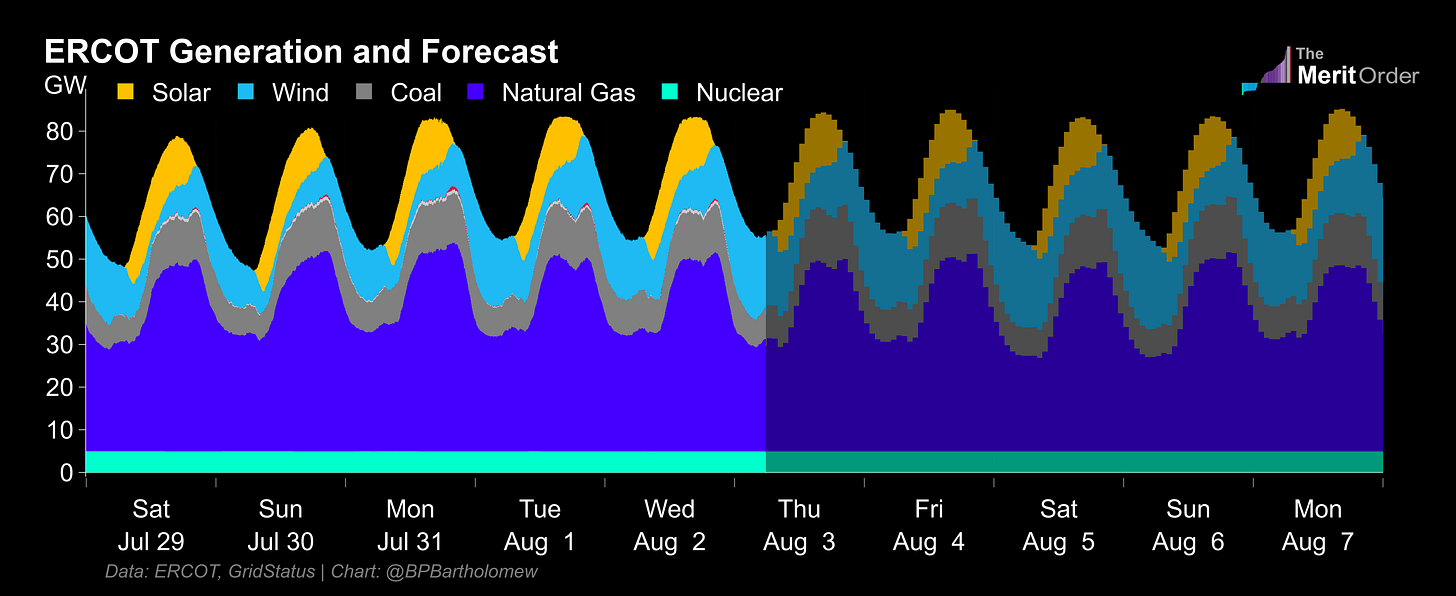

The chart below shows the same view of demand but with supply stacked into available thermal, wind, and solar capacity. Hitting demand peaks on many days (including today) would be impossible without the 10GW+ of solar built since 2018.

The gap between available dispatchable capacity and demand, and the uncertainty it generates, is the crux of ERCOT summer pricing and reliability planning, both today and into the future.

More trends to watch

Natural gas and coal still do the heavy lifting on the Texas grid, especially when demand is highest, but the gap between demand and dispatchable capacity and resulting reliance on wind and solar means that Texas is more than ever a renewable-driven market.

Summer prices are highest and grid conditions are now tightest not on days when demand is strongest, but when demand is relatively high and wind generation slumps too far below its seasonal averages. Net demand is a better indicator than gross demand for Texas grid conditions today.

ERCOT’s burgeoning solar fleet helps put a 13GW+ floor under variable afternoon renewable generation, relieving the market of some its traditional reliance on wind’s daily dice roll.

As solar saturates daytime hours, the most potent ERCOT prices and slimmest reserve margins will continue to migrate from high-demand but sundrenched afternoons to the later evening when demand drops marginally but solar generation falls off a cliff.

Deeper solar penetration means fewer power price spikes for all generators in the daytime hours, but disproportionate cannibalization of its own margins.

Batteries are helping boost reliability ‘under the hood’ by providing several gigawatts of ancillary services; their contribution in energy markets will become more apparent over time as ancillary markets saturate.

Data: ERCOT, GridStatus