US grid-scale energy storage nearly doubled in 2022

Rebounding cost, rising value, record deployment. California and Texas remain protagonists of the utility-scale battery business.

Another year, another record

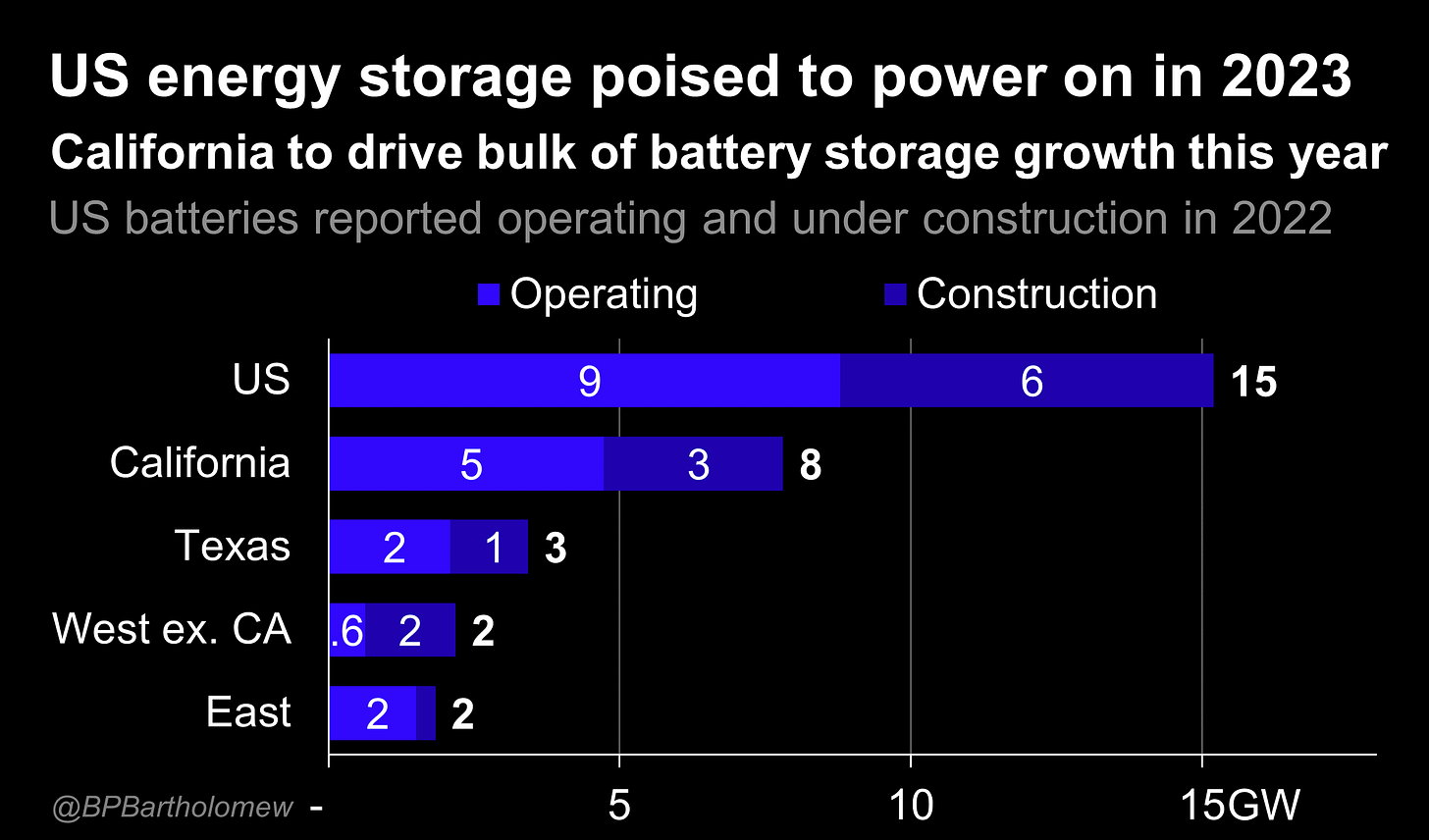

US grid-scale energy storage reached almost 9GW and topped 25GWh by the end of 2022, up from less than 1GW/2GWh at the start of 2020.

Developers commissioned a record 4GW/12GWh of batteries, totals that would have been higher but for supply chain snafus, Covid hangover, and volatile metals pricing.

A Tale of Two Markets

California and Texas remain the protagonists of US grid-scale battery deployment. Collectively, they’ve driven nearly 80% of cumulative installed power capacity, more than 80% of installed energy, and all but one of the >100MW-scale projects.

California alone accounts for more than half of online battery MWs and nearly three-quarters of all installed MWhs.

Duration, duration, duration

Battery business cases differ by market, influencing what configurations get built.

California battery deployment is backstopped by policy mandates and long-term resource adequacy contracts, which carry four-hour duration requirements. Texas developers must make projects pencil on energy and ancillaries alone.

Project durations reflect those varying considerations. Nearly all California batteries feature four-hour duration (or are expanding their way there), while Texas projects have almost exclusively featured under two.

California drives on, non-CA West to power up in 2023

The EIA reports more than 6GW of additional battery projects under construction as of end-2022. California continues to drive the bulk of new construction, with the non-CA west set to join Texas and California as a gigawatt-scale li-ion battery market sometime this year.

The map below shows EIA-reported projects under construction as of December 2022. Developers are doubling down on large four-hour projects to meet California’s policy procurement targets.

Earlier procurements in the non-CA west are also beginning to bear fruit. Arizona and Nevada will add to their fledging battery fleets, while New Mexico and Colorado are set to commission their first large-scale storage projects. In Texas, developers are continuing to move on from the first generation of 9.9MW distribution-connected projects into 100MW-scale batteries that will spend more of their time in energy markets rather than ancillary services.

When will we be able to purchase merit order SWAG with these charts printed?

In 2021 the US consumed 285,246,073 GWh of energy. Almost there.

I'm sure "volatile metals pricing" is just temporary. It's not as though the entire world is trying to do the exact same thing at the exact same time.